Retroactive Tax Credits 2024 California Form – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .

Retroactive Tax Credits 2024 California Form

Source : www.shrm.org

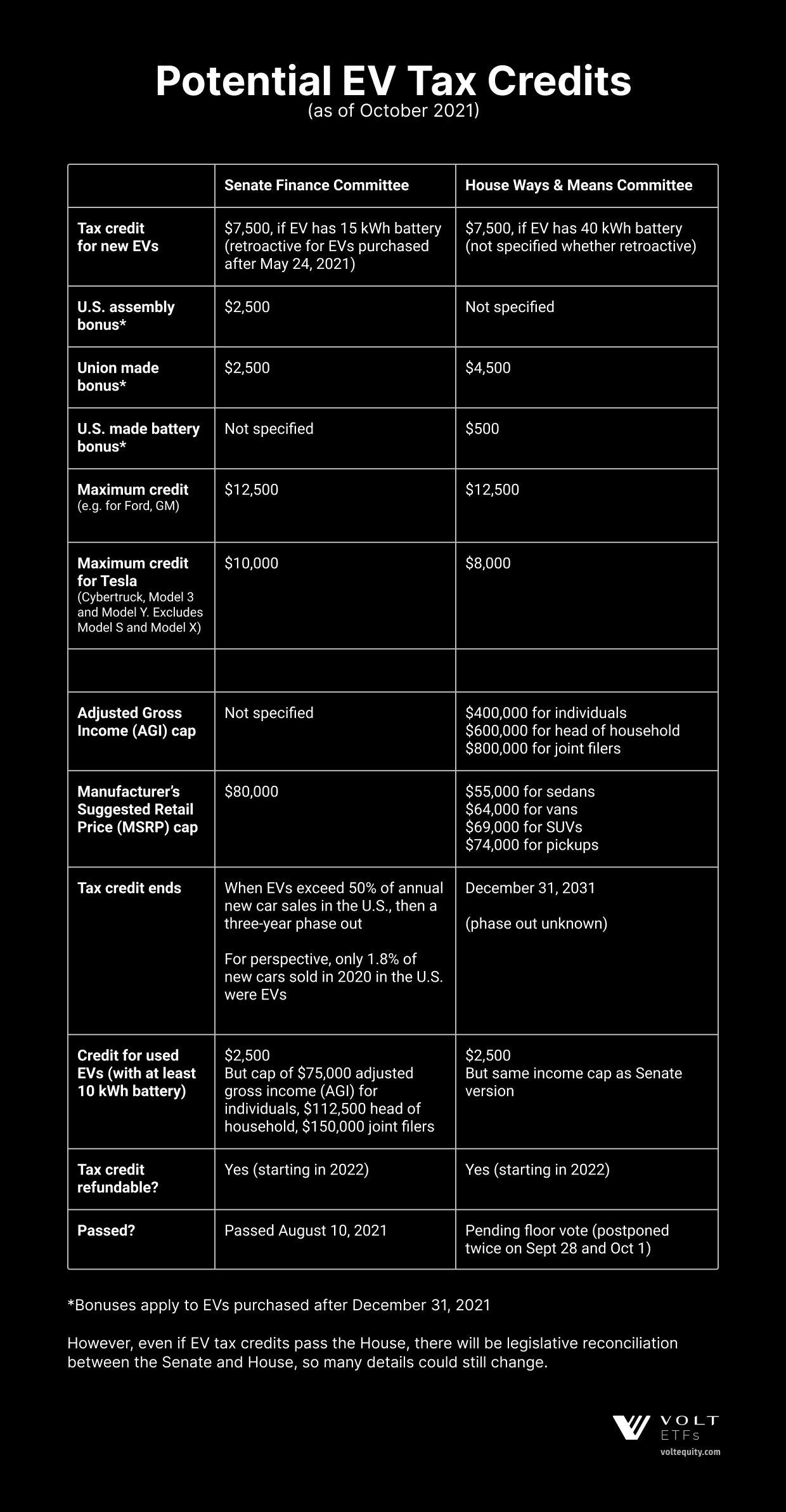

The Tesla EV Tax Credit

Source : www.voltequity.com

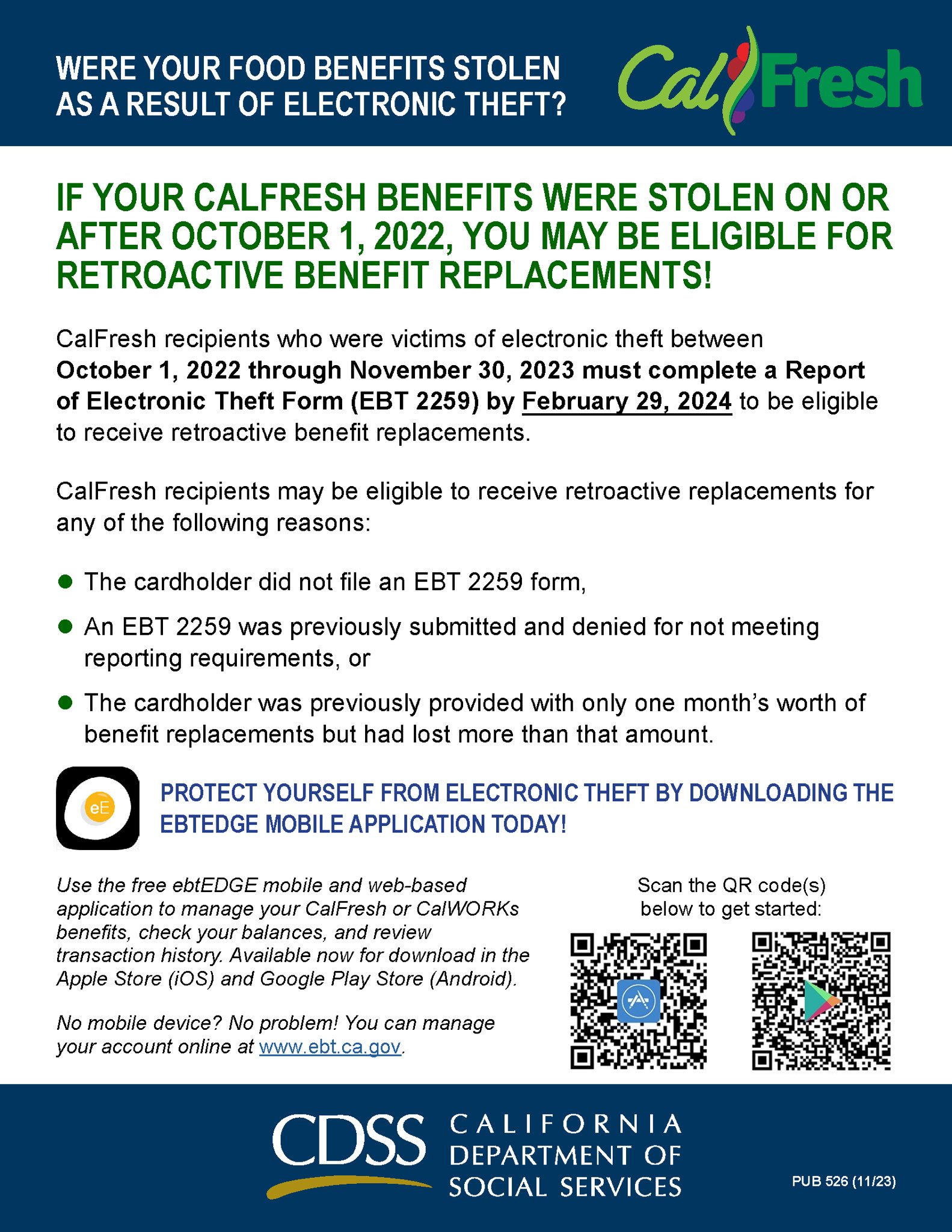

Alameda County Social Services Agency

Source : www.facebook.com

FUTA Credit Reduction: Impact on California Businesses in 2024

Source : californiapayroll.com

OCDA Todd Spitzer (@OCDAToddSpitzer) / X

Source : twitter.com

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

OCDA Todd Spitzer (@OCDAToddSpitzer) / X

Source : twitter.com

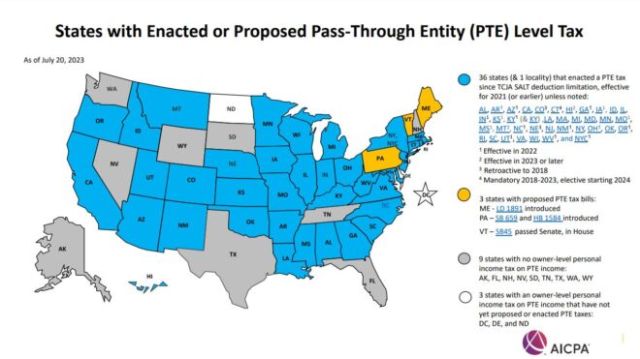

Did you know 36 states have enacted PTE tax laws to enable owners

Source : www.tafttaxinsights.com

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

Did You Know 36 States Have Enacted PTE Tax Laws To Enable Owners

Source : www.mondaq.com

Retroactive Tax Credits 2024 California Form Retroactive Filing for Employee Retention Tax Credit Is Ongoing : This is the fifth post in a series looking back at housing in 2023 and ahead to what 2024 might hold use restrictions when money, in the form of tax credits and other money, off sets those . Flipping the calendar from 2023 to 2024 will for the coming tax season. You can set up a filing system and start watching for the arrival of key documents such as a Form W-2 from your employer .